Manual trading or Trading bots

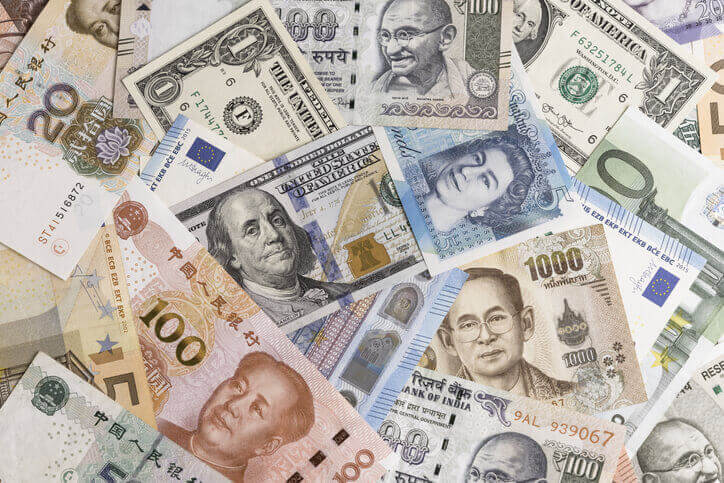

The business model of trading companies offers investors the opportunity to participate in the financial markets of currencies, commodities, precious metals and cryptocurrencies. With the manual traders offered, you do not need any experience or skills in the field of finance or computer programming. So let traders or trading algorithms take care of your money management intelligently and carefully.

Keep in mind that the risk of loss is just as important as the accrued gains. Only invest the amount you are prepared to lose. Start and test the proposed robots with a small starting capital to understand their strategy.

Right now, the cryptocurrency market offers the most encouraging prospects. Arbitech appears solidly positioned to thrive for several years.